Condo Insurance in and around Kingsport

Kingsport! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Condo Sweet Condo Starts With State Farm

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm easy. As one of the leading providers of condo unitowners insurance, you can enjoy terrific service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like pictures, furnishings and videogame systems.

Kingsport! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Why Condo Owners In Kingsport Choose State Farm

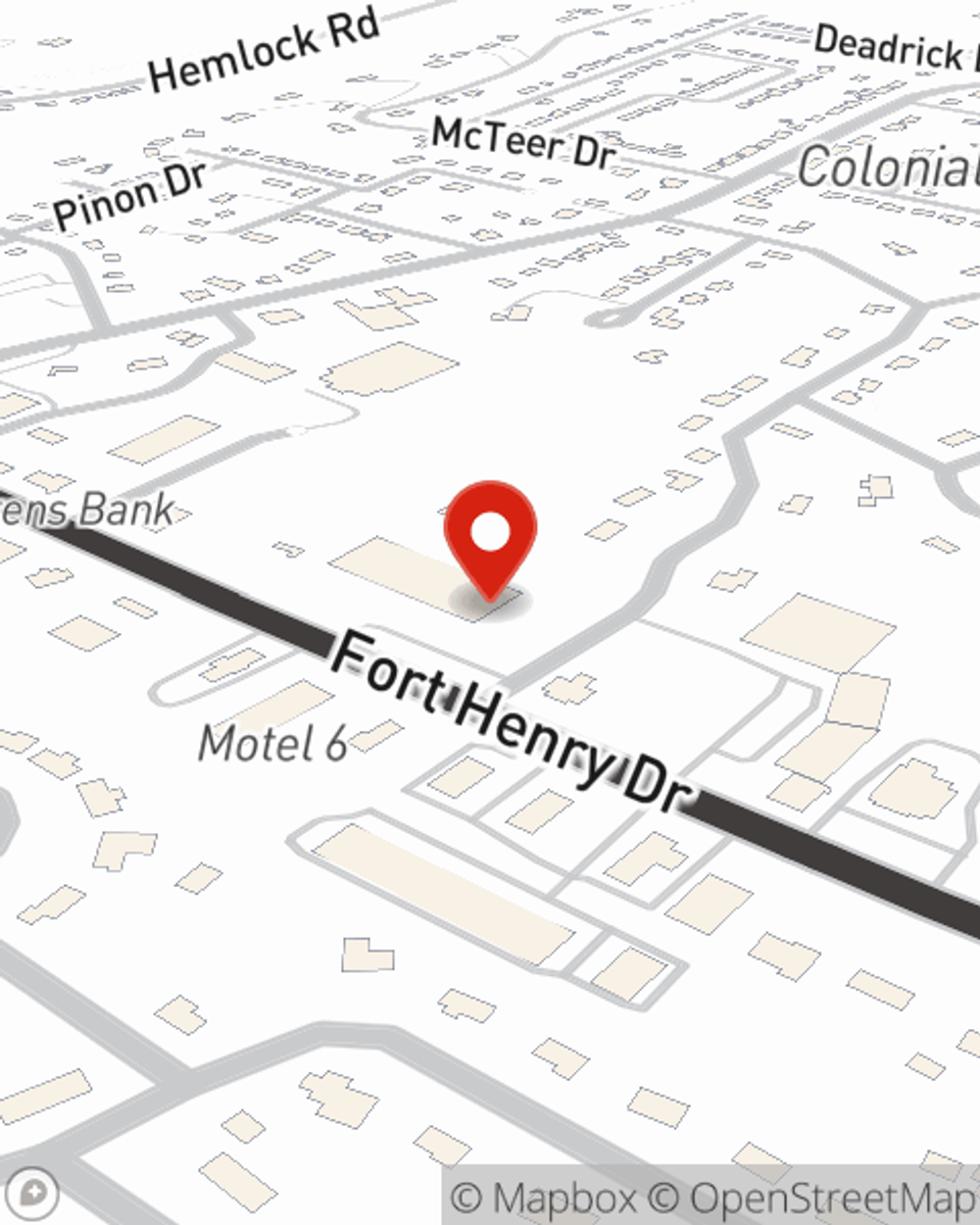

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Bill Lawson can be there whenever you have problems at home to help you submit your claim. State Farm is there for you.

That’s why your friends and neighbors in Kingsport turn to State Farm Agent Bill Lawson. Bill Lawson can help you understand your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Bill at (423) 239-9429 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Bill Lawson

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.